Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

In 2011, the Occupy Wall Street movement, after being ignored and marginalized by the mainstream media, received worldwide attention. The movement was initially inspired by anti-austerity and activist groups in Europe. It drew attention to rising inequality, corruption, corporate greed -- and the ongoing incestuous marriage between governments and the financial sectors. The movement came to represent the voice of "the 99%,": the voice of the quiet majority that had seen over the last decade, as its wealth and its purchasing power eroded, one financial crisis after another.

Within this "99%" of the population, we find of course many young people born after the era of the globalized economy. They were the first ones impacted by the false rhetoric that market globalization would make everyone richer. Indeed, the new economy is not creating any jobs for them. But even the middle class, or what remained of it, came to realize that they were deceived. The monetary gains advertised by Wal-Mart to suburban families and the profits from high-tech jobs, simply burst and gradually dried up.

Despite all the debates and public awareness around the issue of inequality, and despite the fact that the financial sectors and tax systems were designated as the main culprits behind this situation, nothing was seriously done by any government in the world. But the truth is that little can be done by any one government in particular. The global nature of economies today and the relentless flow of funds between countries makes it impossible for one country to take action and still achieve concrete results. Everyone should do their share. Every government should change its tax system and financial regulation so we can all become better off.

In 2014, Thomas Piketty wrote in his book Capital in the Twenty First Century that "the top 10% owns most (70%) of the capital, and the bottom 50% owns almost none (5%) of it." His book was better received in the Anglo-Saxon world than in France where he is originally from. Piketty confirmed with statics, graphs and economic analyses what the activists of Occupy Wall Street movement have been repeating since: that rising inequality and corporate greed are linked together. We can't reduce the shameful problem of inequality if big corporations are not taxed fairly.

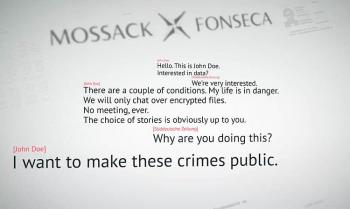

Since the subprime mortgage crisis in 2008 and the huge bailout plans passed to save the big banks under the false pretext that they are "too big to fail," no real reform of the U.S. financial system has been implemented. The mere suggestion of such a thing is seen as an attempt to bring socialism into the land of capitalism. Financial opacity isn't just a disease attacking Russia, China or the Gulf monarchies; it is a global reality. As shown by the Panama Papers leak, even Canada isn't immune from this virus.

The previous Conservative government which boasted (sometimes rightly, we have to concede) about the relative stability of its banking system, did nothing to increase the taxation of big corporations or to impose more transparent measures for private sectors regarding their financial statements, even after the Nortel scandal, which left hundred of Canadians with no pensions.

Furthermore, we also learned through the Panama Papers that the Royal Bank of Canada and subsidiaries were apparently involved in the creation of more than 370 registered shell companies for their clients. Not long before the Panama Papers scandal, it was disclosed through an investigation led by CBC and Radio Canada, that 25 wealthy Canadians used the prominent accounting firm KPMG for a tax "sham" or tax avoidance structure. The identity of these Canadians remains a well-kept secret and no formal inquiry was ordered by the government to tackle these "legal" strategies that the rich can afford and which add to the factors feeding inequality.

So far, Canada like many other countries, refuses to measure the "tax gap." In a nutshell, this gap captures the difference between what the government is expecting to collect in taxes and the amounts it actually receives. The Canada Revenue Agency explains this refusal by saying that it would be costly, difficult and not accurate in the end. Nevertheless, it is one of the many steps that should be implemented to reduce inequality and increase transparency.

Monia Mazigh was born and raised in Tunisia and immigrated to Canada in 1991. Mazigh was catapulted onto the public stage in 2002 when her husband, Maher Arar, was deported to Syria where he was tortured and held without charge for over a year. She campaigned tirelessly for his release. Mazigh holds a PhD in finance from McGill University. In 2008, she published a memoir, Hope and Despair, about her pursuit of justice, and recently, a novel about Muslim women, Mirrors and Mirages. You can follow her on Twitter @MoniaMazigh or on her blog www.moniamazigh.com

Photo: Wikimedia Commons

Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

Comments

Do

Don't